Blog

New Processing Challenges with Plant-Based Beverages

This blog post is a 22 minute read

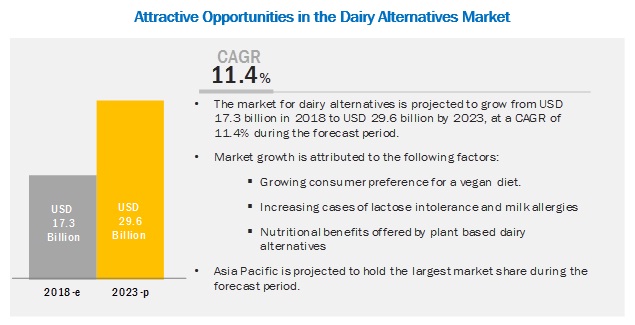

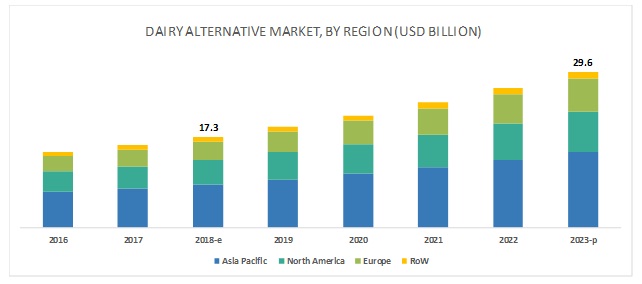

Within the past decade, plant-based dairy alternatives have increased in worldwide demand. The ‘Global Plant-based Beverages Market’ report valued the plant-based beverage industry at USD 17.3 billion in 2018. Additionally, it estimates the demand to surpass USD 29.6 billion by the end of 2023. The market is also likely to expand at a Compound Annual Growth Rate (CAGR) of 14.3% through 2028.

The combined rapid growth and profitability of plant-based dairy alternatives have gained the attention of those in the food industry. As a result, dairy manufacturers are incorporating plant-based alternatives into their production and product offerings.

Attractive Opportunities in the Dairy Alternatives Market

Plant-Based Alternative Beverage Market – Overview

Companies moving into this emerging beverage market are finding success using innovative product launches and strategic partnerships to increase their presence. These innovative product formulations also help to increase the market size and grow demand for more plant-based beverages.

Since 2015, large multi-national dairy companies have acquired technology and have expanded their products containing plant-based foods, beverages, and coffees. These companies are focusing on plant-based dairy alternatives by broadening the appeal of their products and by tapping into innovative dairy replacements and approaches. The plant-based and caffeinated beverage producing companies are vying to discover what consumers want to purchase so they can incorporate those consumer preferences into new products.

New Processing Challenges with Plant-Based Beverages

Dairies that are expanding into the low-acid, plant-based beverage market must update risk assessments and manufacturing procedures to incorporate new physical, chemical, and biological risks as well as technological barriers. Working with raw commodities brings an increased risk of chemical residues like allergens, pesticides, and mycotoxins that differ in prevalence and type compared to raw milk. Manufacturing a broader range of beverages that contain allergenic ingredients, such as soy, tree nut, or gluten proteins, significantly increases the risk of allergen cross-contamination and associated recalls from mislabeling.

The physiological composition of plant-based dairy alternatives also brings processing challenges, as the composition and structure of raw milk are significantly different from plant-derived materials. Consumers are expecting plant-based dairy alternatives to have similar physiochemical and sensory attributes. From creaminess, mouthfeel, and color, to how these plant-based beverages react when used in cold and hot temperatures, consumers want their plant-based beverages to feel and taste like milk.

Therefore, dairy processors are working to create ways to create not only a similar nutritional specification but also the stability and homogeneity of products. They are blending plant oils, water, emulsifiers, and other additives. Once combined, manufacturers thermally process all the ingredients to produce a stable product with the desired attributes.

Differences in environmental conditions of raw materials lead to diverse microorganisms entering the processing plant. This diversity increases the risk of microbiological contamination and requires a broader understanding of the effects of pH, water activity, and upstream processing of raw ingredients compared to traditional dairy.

When manufacturers sell these beverage alternatives as shelf-stable without the need for refrigeration, microbiological challenges increase. Beverage companies perform accelerated shelf-life testing of the products to release them for sale. Companies need to warehouse products as they wait for results; therefore, the faster they detect contamination, the shorter the time to release product. To reduce quarantine time and warehouse space, companies apply more rapid prediction methods using microbial Adenosine Triphosphate (ATP) or flow cytometry to replace traditional microbial growth indicators like pH or aerobic count.

Consumer Trends Inclined Toward Replacing Dairy with Plant-Based Alternatives

Over time, dairy milk consumption continues to decline, with each generation drinking fewer milk beverages than its predecessor. In Britain, for example, 25% of consumers are choosing plant-based beverages over traditional dairy beverages – with figures being as high as 33% for the young adult market (16 to 24-year-olds).

Increased awareness of lactose intolerance and dairy allergies is also driving interest to the plant-based beverage market. Ethnic origins impact the frequency of lactose intolerance: in South America, Africa, and Asia, over 50% of the population is intolerant. In some Asian countries, 100% of the population is intolerant. Yet in Northern Europeans, the intolerance range is between 5-17%. With the highest global rate of lactose intolerance, the Asian market also accounts for the largest share of the plant-based beverage market to date.

Awareness among consumers about the benefits of a vegan diet is another factor propelling the demand for plant-based dairy alternatives across the world. Several economies have seen a substantial increase in the vegan population. These consumers prefer dairy alternatives like soy, almond, rice, and other plant-based dairy alternatives as a substitute for dairy milk.

Because there is no stated definition, the Journal of Food Science and Technology attempted a general classification of the plant-based dairy alternatives. The five categories are:

· Cereal based: Oat, Rice, Corn, Spelt

· Legume based: Soy, Peanut, Lupin Cowpea

· Nut based: Almond, Coconut, Hazelnut, Pistachio, Walnut

· Seed based: Sesame, Flax, Hemp, Sunflower

· Pseudo-cereal based: Quinoa, Teff, Amaranth

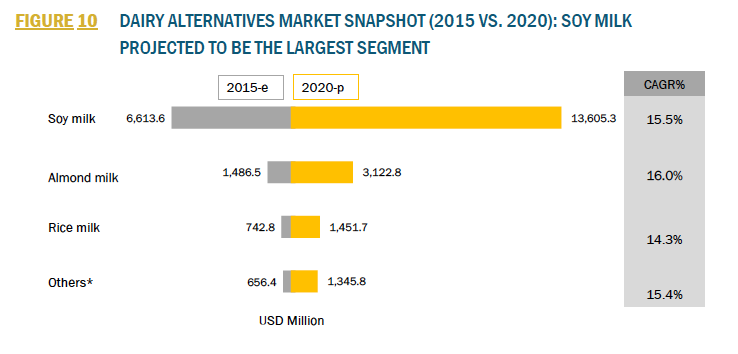

Soy is the most consumed plant-based alternative in the world, dominating more than half of the total market share in 2018, and growing at CAGR of around 14%. The North American market demand for almond beverages was higher than soy milk for the first time.

Oat beverages are growing in popularity due to their neutral taste and naturally creamy texture, which helps increase the demand when pairing with caffeinated beverages as well as on its own. Oat-based drinks fit a unique position of providing functionality more like dairy beverages while also appealing to consumers interested in sustainably sourced products.

There is controversy when companies label plant-based extracts as “milk.” The alternative beverage demand and market share are growing, and nutritional labeling requirements are changing to reflect the need to inform consumers about the products they are purchasing.

About Charm Sciences

Established in 1978 in Greater Boston, Charm Sciences helps protect consumers, manufacturers, and global brands from a variety of issues through the development of food safety, water quality, and environmental diagnostics tests and equipment. Selling directly and through its network of distributors, Charm’s products serve the dairy, feed and grain, food and beverage, water, healthcare, environmental, and industrial markets in more than 100 countries around the globe.